Open Banking Pilot for a Leading Canadian Bank

Names and parties anonymised. Hostnames are masked for confidentiality.

Executive Summary

A major Canadian bank wanted to prove Open Banking readiness ahead of regulation. The goal was a production-ready pilot demonstrating secure Third Party Provider (TPP) onboarding, alignment with global standards (FAPI, OIDC, FDX), and seamless integration with the bank's existing customer authentication hub.

Opendata Consult (contracted via a prime systems integrator) designed and delivered an end-to-end ecosystem using an OAUth identity provider (PingFederate) and a Trust Platform (Raidiam Connect) to manage certificates, Software Statement Assertion (SSAs) issuance, and various other flows and journeys. Within months the bank had a branded sandbox→test→production path supporting multi-brand TPP onboarding, customer logon, consent journeys, and token-secured API access.

- End-to-end standards alignment: FAPI 1.0 Advanced, OIDC, and FDX patterns proven in pilot

- Secure DCR onboarding using SSAs and x.509 certificates

- Consent journeys integrated with the bank's existing authentication hub

- Developers, architects, and support teams upskilled to operate and extend the stack

Architecture at a Glance

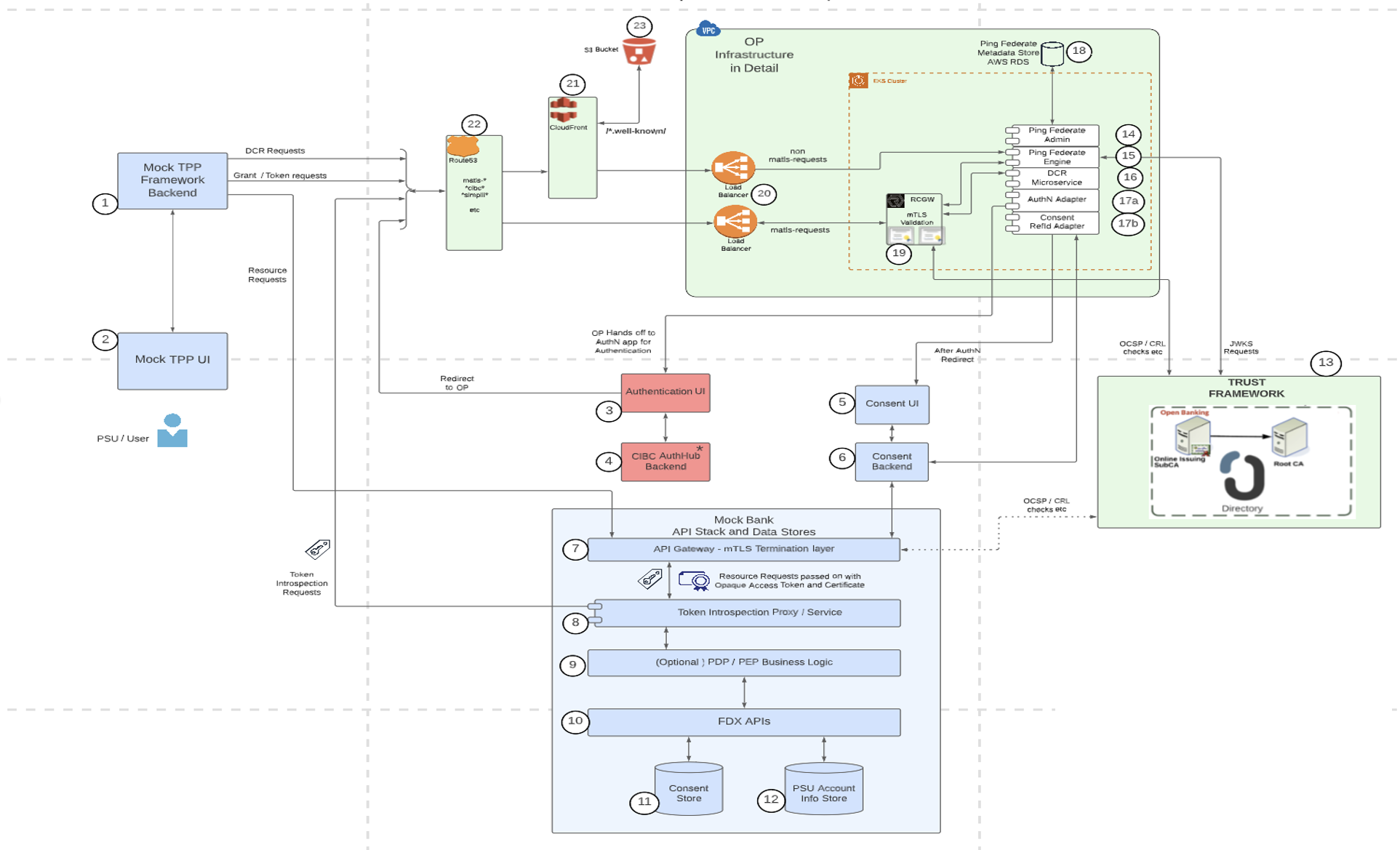

The pilot established a multi-brand pattern: each brand maps to brand-scoped authorisation servers and consent flows. A Trust Platform handled certs/SSAs; PingFederate acted as the OP/AS; consent was externalised using PingFederate adapters; FDX APIs and stores validated token-secured resource access.

Click the diagram to open it full size in a new tab.

Technical Deep Dive

The Challenge

- Prove compliance with FAPI 1.0 Advanced and OIDC without re-platforming the bank's AuthHub

- Enable Dynamic Client Registration (DCR) using SSAs and x.509 certificates for TPP onboarding

- Demonstrate interoperability with FDX APIs; explore Rich Authorisation Requests (RAR) readiness

- Stand up multiple AWS environments (Dev, SIT, UAT, Prod) quickly and repeatably

- Handle multi-brand routing and brand-specific consent experiences

- Operate within evolving/ambiguous FDX guidance vs. prescriptive UK/Brazil models

Multi-brand & Environment Topology

We implemented a brand-aware routing model: the left-most FQDN segment encodes brand (e.g.,

https://{brand}.{bank}.example/pf/...) and maps to a brand-scoped authorisation server instance and consent

flow. Dev, PoC, and higher environments used consistent patterns to ensure parity and ease of testing.

- Brand scoping: distinct PingFederate adapter instances and consent resume paths per brand

- Repeatability: infrastructure and configuration automated to reproduce across Dev→UAT→Prod

- Separation of concerns: commissioning/trust material isolated from brand orgs (see "Trust & Onboarding")

Trust & Onboarding (SSAs, Certs, DCR)

The Trust Platform (Raidiam Connect) handled software statement issuance and certificate lifecycle. TPPs onboarded via DCR using their software statements and transport/signing certificates. This delivered a provable, auditable onboarding process.

- Self-service onboarding: TPPs used SSAs + certs to register via DCR endpoints exposed by the federation layer

- Interoperability: DCR aligned with internationally proven patterns to reduce vendor lock-in

- Governance: roles and claims configured to enforce capability boundaries per TPP and brand

Federation & Consent (PingFederate externalised)

PingFederate acted as the OIDC OP/AS and integrated with the bank's existing AuthHub for PSU login. Consent was externalised using the PingFederate Reference ID Adapter pattern. We wrote a lightweight Golang consent adapter to bridge PingFederate with the consent backend and a JavaScript frontend to exercise the PSU consent flow end-to-end (also used by a demo TPP application).

- OP/AS functions: token issuance, introspection, revocation (RFC 7009), and well-known discovery

- Consent externalisation: PingFederate issues a reference, redirects to consent app; upon completion, PingFederate resumes the flow

- Brand-specific consent: adapter instances and UI themes per brand, routed by FQDN

Token Strategy (Opaque vs JWT), Dev→Prod

Early builds used JWT access tokens; we then moved to opaque tokens for better centralised control. This involved switching PingFederate Access Token Managers, updating DCR service settings, and promoting changes via CI/CD.

- Update PingFederate to use opaque token managers for selected AS instances

- Adjust DCR microservice configuration (Helm/ConfigMap) to register clients against the new token manager

- Rollout sequence: Dev first, validate E2E, then UAT/Prod

# [Example snippet: Kubernetes ConfigMap fragment for DCR settings] data: ACCESS_TOKEN_MANAGER_ID: "opaque_manager" ID_TOKEN_MANAGER_ID: "jwt_manager" # ...

# [Example snippet: kubectl commands used during pilot] kubectl -n obp edit configmap dcr-config kubectl -n obp rollout restart deployment dcr-service

Interface Agreements & Validation (anonymised)

The browser authorization request was packaged as a signed request JWT including PKCE parameters and brand-specific ACRs. The consent service returned the user to PingFederate via a brand-scoped resume endpoint; issued tokens carried the required identifiers.

{

// [Example snippet: Request JWT header]

"alg": "PS256",

"typ": "JWT",

"kid": "{masked-key-id}"

}

--

{

// [Example snippet: Request JWT payload]

"client_id": "{tpp-client-id}",

"redirect_uri": "https://{tpp}.{example}/cb",

"scope": "openid accounts consent fdx:read",

"response_type": "code",

"code_challenge_method": "S256",

"code_challenge": "{masked}",

"acr_values": "urn:ca:ob:brand:{brand}",

"state": "{masked}",

"nonce": "{masked}"

}

# [Example snippet: Brand-aware PingFederate resume path]

https://{brand}.{bank}.example/pf/as/{brand}/resume/as/authorization.ping?REF={masked-ref}

{

// [Example snippet: ID Token claim shape]

"iss": "https://{brand}.{bank}.example/pf",

"aud": "{tpp-client-id}",

"sub": "{ecif-xref}",

"azp": "{tpp-client-id}",

"consent_id": "{masked-consent-id}",

"channel_id": "{brand}",

"nonce": "{masked}",

"auth_time": 1690000000

}

Security Controls

- mTLS at ingress with OCSP/CRL checks for client certificate validity

- Least-privilege scopes aligned to approved capabilities per TPP and brand

- Auditability: consent decisions and token events logged for traceability

Engineering Notes (the "real world" bits)

- Refactored client-lookup code to avoid iterating over all clients at scale

- Resolved environment-specific quirks (e.g., CDN/cipher alignment in non-Dev tiers)

- Improved trust framework hygiene: split "commissioning org" (critical CA/SSA assets) from brand orgs; locked down permissions to avoid accidental deletion

- Kept a brand-specific "do not delete" convention for trust assets; automated as much as possible via pipelines

TPP App & Developer Experience

We built a lightweight TPP app and a Postman-driven toolkit to prove end-to-end flows (SSA → DCR → PSU login → consent → FDX API call). The app doubled as a demo vehicle for stakeholders and a template for external partners.

- Minimal variables required; discovery endpoints handled automatically

- Private Key JWT and PKCE built-in; reduces setup friction for partners

Conformance & Testing

- OpenID Foundation FAPI profile tests executed against brand-scoped endpoints

- End-to-end UATs covering consent, token issuance, and FDX resource access

- Operational readiness: log/monitoring checks, SOPs for support teams

Delivery Experience

Opendata Consult led architecture and hands-on engineering, co-hosting workshops with Canadian stakeholders on authentication, authorisation, and consent. We collaborated across identity, security, and API teams to land a multi-brand pilot that mirrored production realities.

Outcomes

- End-to-end Open Banking flow demonstrated: SSA → DCR → PSU logon → consent → token-secured FDX API access

- Multi-brand pilot stood up across environments with brand-aware routing and consent experiences

- Bank teams trained to manage environments, onboard TPPs, and operate consent/token lifecycles

- Positioned as an early Canadian bank to show practical FAPI/FDX interoperability in a production-ready path

Lessons Learned

- RAR timing: vendor support lagged the spec; we designed for it but prioritised core flows

- FDX consent ≠ UK/Brazil: differences required fresh IA design and careful stakeholder comms

- Multi-brand complexity: worth the realism; enforce strict org/asset hygiene to avoid accidental trust breakage