Understanding Optional SSAs in FDX: DCR with and without Software Statements

In the world of Dynamic Client Registration (DCR), one acronym tends to trip up even experienced implementers: SSA. While Open Banking specs like the UK's and Brazil's mandate Software Statement Assertions, the FDX spec takes a different approach-SSAs are optional. But what does that mean in practice, and how do you build for both worlds without shooting yourself in the foot?

What's a Software Statement Assertion (SSA)?

An SSA is a signed JWT issued by a trusted authority-typically a central directory or governance body-that vouches for a client's identity and metadata during the registration process. Think of it as a tamper-proof introduction letter between your fintech app and a data holder's authorisation server (AS).

This assertion contains claims like:

- Client name and description

- Redirect URIs

- Grant types, response types

- JWKS URI for key discovery

- Organisation and software identifiers

- Signature and expiry time

In heavily governed ecosystems like the UK's Open Banking or Open Finance Brasil, the SSA is non-negotiable. No SSA, no onboarding. But FDX throws a curveball: it's not mandatory.

FDX's Position: SSA Optionality

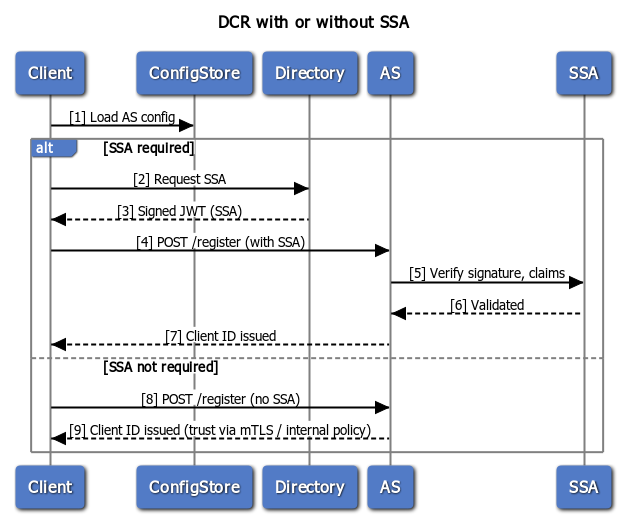

The FDX specification allows for both SSA-based and SSA-less registration. This flexibility makes sense when you consider the North American ecosystem:

- No central directory comparable to the UK's OB Directory

- Wider range of bilateral agreements between TPPs and data holders

- Desire to support legacy OAuth setups where SSA infrastructure doesn't exist

However, this optionality means additional complexity for implementers. As a fintech, you can't just assume all banks will follow the same rules. Some will expect a software_statement. Others will ignore it entirely.

When to Include the SSA-and When Not To

From an implementation standpoint, here are typical conditions for each path:

- Include an SSA if the data holder:

- Publishes SSA requirements in their developer portal

- Is part of a closed ecosystem that provides SSA issuance

- Rejects registrations missing software_statement

- Skip the SSA if:

- The data holder explicitly says it's not required

- You're using mutual TLS or manual vetting as a trust anchor

- The registration process is tightly coupled to a commercial agreement

Ideally, this decision should be made dynamically per target AS, based on metadata or environment configuration.

Annotated SSA Payload (JWT Claims)

{

"client_name": "My Fintech App",

"redirect_uris": ["https://myapp.com/callback"],

"grant_types": ["authorization_code"],

"response_types": ["code"],

"jwks_uri": "https://myapp.com/jwks.json",

"scope": "openid accounts",

"software_id": "abc123-456def",

"software_roles": ["data_recipient"],

"org_id": "fintech-co",

"authority_url": "https://fdx.directory.example",

"iss": "https://fdx.directory.example",

"exp": 1715208397,

"iat": 1715204797

}

Key fields:

-

software_id: Unique to your software product, issued by the directory -

org_id: Your legal entity identifier, registered with the governance body -

jwks_uri: Where your public keys live for token and request signing -

authority_url: The directory or SSA authority that issued this JWT

Sequence Diagram: Supporting Both SSA and Non-SSA Flows

Node.js Example: Registering with and without SSA

Here's a basic Node.js implementation using Axios that supports both paths:

const axios = require("axios");

async function getSSA(directoryUrl) {

const { data } = await axios.get(directoryUrl);

return data; // Assumes the response is the signed JWT

}

async function registerClient({ metadata, config }) {

const payload = { ...metadata };

if (config.requireSSA) {

payload.software_statement = await getSSA(config.directoryUrl);

}

const response = await axios.post(config.registerUrl, payload, {

headers: { "Content-Type": "application/json" },

httpsAgent: config.mtlsAgent

});

return response.data;

}

This snippet uses a `requireSSA` flag and gracefully degrades if the SSA isn't needed. You could extend this to support fetching a fresh JWKS before registration or caching SSAs locally.

Pro Tips from the Trenches

- Validate the SSA before sending it-check expiry, issuer, and audience

- Cache SSA tokens per client for reuse across environments

- Don't hardcode JWKS URIs-load them dynamically via SSA or config

- Log rejected SSA claims clearly-they're your best debug signal

- If the AS returns

invalid_software_statement, verify base64 encoding and JWT structure

Closing Thoughts

The optional SSA model in FDX is a classic case of "flexibility at a cost." It opens the door to lightweight integrations where appropriate, but it also demands that implementers be smarter, more adaptable, and slightly paranoid.

If you're building a unified DCR client across multiple ecosystems, treat SSA as a plug-in: load it when required, skip it when not, and validate it always. And remember-just because it's optional doesn't mean it's never needed.